Our Blog

Healthcare plans and insurance options are constantly changing, which can make it hard to understand what your policy covers. For more information on insurance industry news, tips to keep you covered, and changes to popular plans, follow the Advanced Insurance Concepts blog.

Retiring at Age 40

Retiring at any age is possible, just a few things to think about when you are ready. The average age to retire is typically 66, allowing you decades to save. The younger you want to retire, the more aggressive you’ll need to save. Retiring at a younger age, like 40; requires an aggressive savings strategy.…

Are You Required to Have Health Care Coverage in Kansas?

As of January 1, 2014, most U.S. citizens and legal residents are required by law to have qualifying health care coverage or pay an annual tax penalty for every month they go without insurance. This is called the “individual mandate.” Beginning in 2014, the penalty for not having qualifying coverage is $95 per adult and $47.50…

What Is Funeral Insurance?

Deciding whether to purchase funeral insurance can be difficult. Funerals can be pricy with burial service, caskets or urns, flowers and other related items. It’s important to understand the advantages and disadvantages of your insurance. Funeral insurance, also called burial insurance or final expense insurance, is specifically designed to cover funeral related expenses. It’s typically…

How to Choose a Medicare Supplement Plan

Choosing a Medicare supplement plan can be stressful. One way to get the most out of your search is to identify all the essentials you may want and think long term and what you might need down the road. Here are a few do’s and don’ts on what to do when looking for a Medicare…

What Does Part A and Part B Mean, and Do I Need Them?

Medicare Part A and Part B are two different types of coverage. You’ll have to decide for yourself what best suites your health needs. Medicare Part A covers inpatient care in hospitals, skilled nursing facility care, hospice care and home health care. Medicare Part B helps cover services from doctors and other health care providers,…

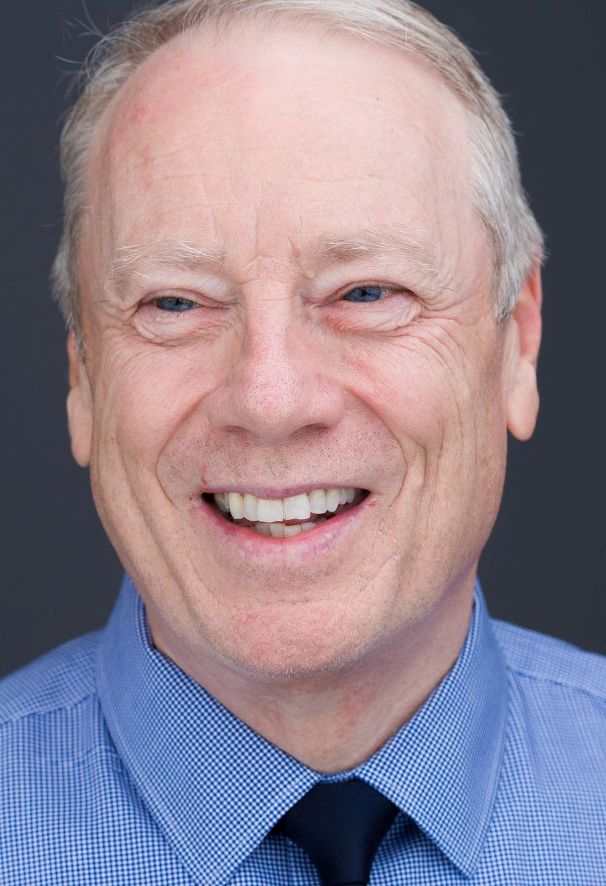

How Can Jim Rooney Help With Your Insurance Needs

If you are in the market for insurance, Jim Rooney has you covered with life insurance, whole life insurance, term life insurance, universal life insurance and final expense insurance. Whether you are starting out young or old, low income or high income or know nothing about insurance. Jim Rooney can walk you through all the…

Remove the Burden From Family and Friends, Get Final Expense Insurance

Losing a loved one can be an emotional time. The last thing any loved one wants is to worry about final burial expenses. One way to prevent this is to have final expense insurance, also called burial insurance or funeral insurance. The average funeral expense costs around $11,000 and around $6,000 for cremation. Final expense…

What Are the Key Differences Between Medicare and Medicaid?

Both Medicare and Medicaid are health care programs that provide government assistance to people in need of health care support. And that is where many of the similarities end. Medicare is available for people 65 years or older or those who qualify for disability or end-stage renal disease. Medicaid availability varies from state to state.…

Are Annuities A Good Investment?

If you are looking for a reliable income stream during retirement, annuities are a good investment. Annuities are guaranteed income, not an equity investment with high growth. Some do not consider annuities investments. Annuities are an insurance product that will provide guaranteed income in retirement. But they do provide an income for life. Another benefit…

How to Budget for Retirement

Retirement means different things to different people. Perhaps it means spending more time with family, reducing the hours you work or not working at all. Once you’ve determined what you want your retirement to be, it’s important to know how to get there financially. First step is to define your retirement. Focus on the ideas…